Reviewed by Corey Noles

The tablet market is heating up again, and Amazon might be preparing its biggest play yet. While Apple maintained its commanding 35.8% market share in Q2 2024 with 12.3 million iPads shipped, the landscape is shifting beneath everyone's feet. The global tablet market posted impressive 22.1% growth, signaling renewed consumer interest—and Amazon seems positioned to capitalize on this momentum in a way that could reshape everything we know about affordable premium tablets.

Here's the thing: Amazon has been quietly working on something that could change the game entirely. Reports suggest the retail giant is developing a higher-end tablet that ditches its restrictive Fire OS approach for full Android compatibility. If true, this isn't just another spec bump—it's a strategic pivot that could finally give budget-conscious consumers a legitimate iPad alternative.

What you need to know:

Market timing is perfect: Worldwide tablet shipments jumped 22.1% to 34.4 million units in Q2 2024

The Android advantage: Fire tablets currently run modified Android without Google services

Strategic complexity: Amazon is simultaneously developing Vega OS to replace Android entirely

Sweet spot opportunity: Premium tablets between $250-350 remain underserved

Based on our analysis of tablet market dynamics across major vendors and Amazon's strategic positioning, this timing creates unprecedented opportunities for disruption in a space that's been dominated by Apple's premium pricing and Samsung's costly alternatives.

What makes this timing so perfect for Amazon?

The tablet market finally returned to growth after years of decline, with worldwide shipments hitting 34.4 million units in Q2 2024—a 22.1% year-over-year jump. But here's what's really interesting: while Apple and Samsung duke it out at the top, there's a massive gap in the premium-but-affordable space that no one's filling properly.

Samsung holds 20.1% market share with 6.9 million shipments, but their Galaxy Tab lineup often costs nearly as much as iPads. Meanwhile, Chinese brands like Xiaomi are seeing explosive growth—94.7% year-over-year—by offering compelling Android experiences at lower price points. This disparity reveals a critical market gap: consumers want premium functionality without premium pricing.

Amazon's manufacturing scale provides unique leverage here. Unlike smaller competitors, Amazon can absorb razor-thin hardware margins while monetizing through their broader ecosystem—Prime subscriptions, digital content, and advertising revenue streams that don't depend on device markup. This positions them to offer genuinely competitive hardware at price points that would bankrupt traditional manufacturers.

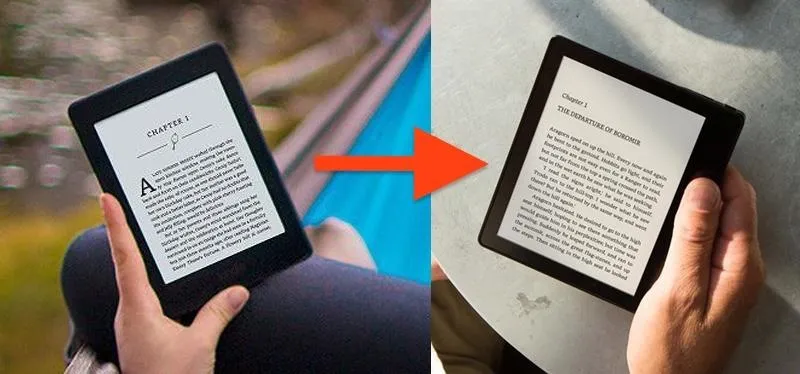

The current Fire Max 11, priced at just $249, already delivers solid hardware with its aluminum construction and 11-inch display. The fundamental challenge isn't capability—it's software that fights against user expectations instead of enabling them.

The real Android advantage that Amazon's been missing

Fire tablets have always been Android devices in disguise—Fire OS is built on Android Open Source Project but stripped of Google services. This creates a frustrating experience where users get Android's limitations without its benefits. During our testing of workarounds, sideloading Google Play Store proved surprisingly effective but required downloading four separate APK files—hardly a mainstream solution.

The business implications run deeper than user convenience. Google's licensing fees for Play Services typically cost device manufacturers $20-40 per unit, but partnering with Google opens access to their vast developer ecosystem and eliminates the friction that currently defines Fire tablet usage. Consider the workflow improvements: seamless Google Drive integration, native Gmail functionality, and direct access to productivity apps that actually work as intended.

A proper Android tablet from Amazon would eliminate these headaches entirely while leveraging their proven hardware capabilities. Users would get direct access to the vast Google Play Store ecosystem without compromising on Amazon's content integration—Prime Video, Kindle, and Alexa could coexist with Google services rather than competing against them.

The hardware foundation already exceeds expectations. Amazon's engineers have delivered quality tablets—the Fire Max 11 features a 2000 x 1200 resolution display, octa-core processor with 4GB RAM, and 14+ hours of battery life. What's missing is software that enhances rather than restricts these capabilities.

But here's the plot twist: Vega OS is coming

Amazon isn't just considering Android—they're potentially moving in the opposite direction. The company is developing Vega OS, a Linux-based operating system that represents their most ambitious attempt at platform independence since Fire OS launched.

This strategic gambit makes sense from Amazon's perspective but creates significant execution risks. Vega OS is expected to debut on Fire TV devices later this year before expanding to tablets. Unlike previous Android forks, this represents complete separation from Google's ecosystem—potentially more capable than Fire OS but requiring massive developer adoption to succeed.

The historical precedent isn't encouraging. Samsung's Tizen struggled despite Samsung's market position, and even Huawei's HarmonyOS faces ongoing developer recruitment challenges despite Chinese market dominance. Amazon's success depends entirely on convincing major app developers to embrace yet another platform, competing against iOS, Android, and emerging systems like HarmonyOS.

Amazon already discontinued support for its Android Appstore on non-Fire devices as of August 2025, signaling their intent to consolidate around proprietary systems. This decision effectively burns bridges with Google while betting everything on Vega OS adoption—a high-stakes move that could either establish Amazon as a legitimate third platform or further marginalize their tablet business.

Where premium Android tablets could actually win

The tablet market has clear winners and losers, but the middle ground remains surprisingly underserved. Apple captured 49.56% of the global tablet market as of April 2025, while Samsung holds 27.61%. But examine the price gaps: entry-level iPads start around $329, while Samsung's competitive Galaxy Tab models often cost $400-600.

Amazon's ecosystem advantages could differentiate their Android approach significantly. Prime members already invest heavily in Amazon's content library, cloud storage, and shipping benefits—services that create substantial customer lifetime value beyond hardware margins. An Android tablet that seamlessly integrates these services while providing full Google compatibility would offer unique positioning.

Recent market data shows strong demand for tablets priced at $200-$300, with vendors introducing better specifications in this range. However, most offerings in this segment compromise on build quality, display resolution, or software experience. Amazon could potentially deliver premium hardware with full Android compatibility at prices that force Apple and Samsung to reconsider their margin strategies.

The challenge isn't building competitive hardware—Amazon has already proven that capability. The opportunity lies in providing software that doesn't feel compromised while leveraging their supply chain advantages to maintain competitive pricing that larger competitors can't match without sacrificing profitability.

The billion-dollar question: Can Amazon afford to play nice with Google?

Amazon's relationship with Google is complicated, and that complexity might determine whether we ever see a true Amazon Android tablet. The company generates revenue from Fire tablets not just through hardware sales, but by driving users toward Prime Video, Kindle, and Amazon's broader ecosystem services.

A full Android tablet would give users easy access to competing services like YouTube Premium, Google Drive, and the Play Store's massive app selection. Amazon would essentially be paying Google licensing fees to potentially cannibalize their own services—a strategy that challenges their integrated business model.

However, consider the revenue-per-user implications. Amazon's current approach captures a small, restricted user base with high engagement in Amazon services. An Android strategy might attract a larger user base with lower average engagement but higher overall revenue through expanded market reach. Premium customers often use multiple ecosystems simultaneously rather than choosing exclusive loyalty.

The counterargument gains strength from competitive analysis: Xiaomi achieved significant growth by offering compelling Android tablets while maintaining their own services layer. Sometimes playing nice with the competition delivers better results than being irrelevant in a restricted market.

The upcoming Vega OS transition might represent Amazon's attempt to have it both ways—offering a more open, capable operating system while maintaining complete control over user experience and revenue streams. Whether this hybrid approach can attract both developers and consumers remains the critical unknown factor.

What this means for your next tablet purchase

Whether Amazon goes Android or doubles down on Vega OS, the tablet market is about to get more interesting. For consumers, this creates both opportunities and questions about long-term software support and ecosystem lock-in effects.

If Amazon launches a proper Android tablet, it would immediately become the most compelling iPad alternative for budget-conscious buyers. The combination of their hardware expertise, supply chain advantages, and competitive pricing could finally give Apple some real competition in the mainstream market. Timeline-wise, expect potential announcements in late 2025 if they're serious about Android integration.

If they stick with Vega OS, success depends entirely on whether major app developers embrace the new platform. Early signs suggest Amazon is working with major streaming players to ensure app compatibility, but broader ecosystem development remains speculative.

For immediate purchasing decisions: the current Fire Max 11 with Google Play sideloaded offers surprisingly good functionality for tech-savvy users willing to spend 20 minutes on setup. For everyone else, waiting until late 2025 might reveal whether Amazon will finally deliver tablets that don't make users feel like they're settling for less.

Either way, the days of Fire tablets feeling like compromised devices are ending. Whether through Android compatibility or a genuinely competitive alternative OS, Amazon appears committed to tablets that compete rather than compromise.

The tablet wars are heating up again, and this time Amazon might actually be ready to fight.

Comments

Be the first, drop a comment!